Award-winning PDF software

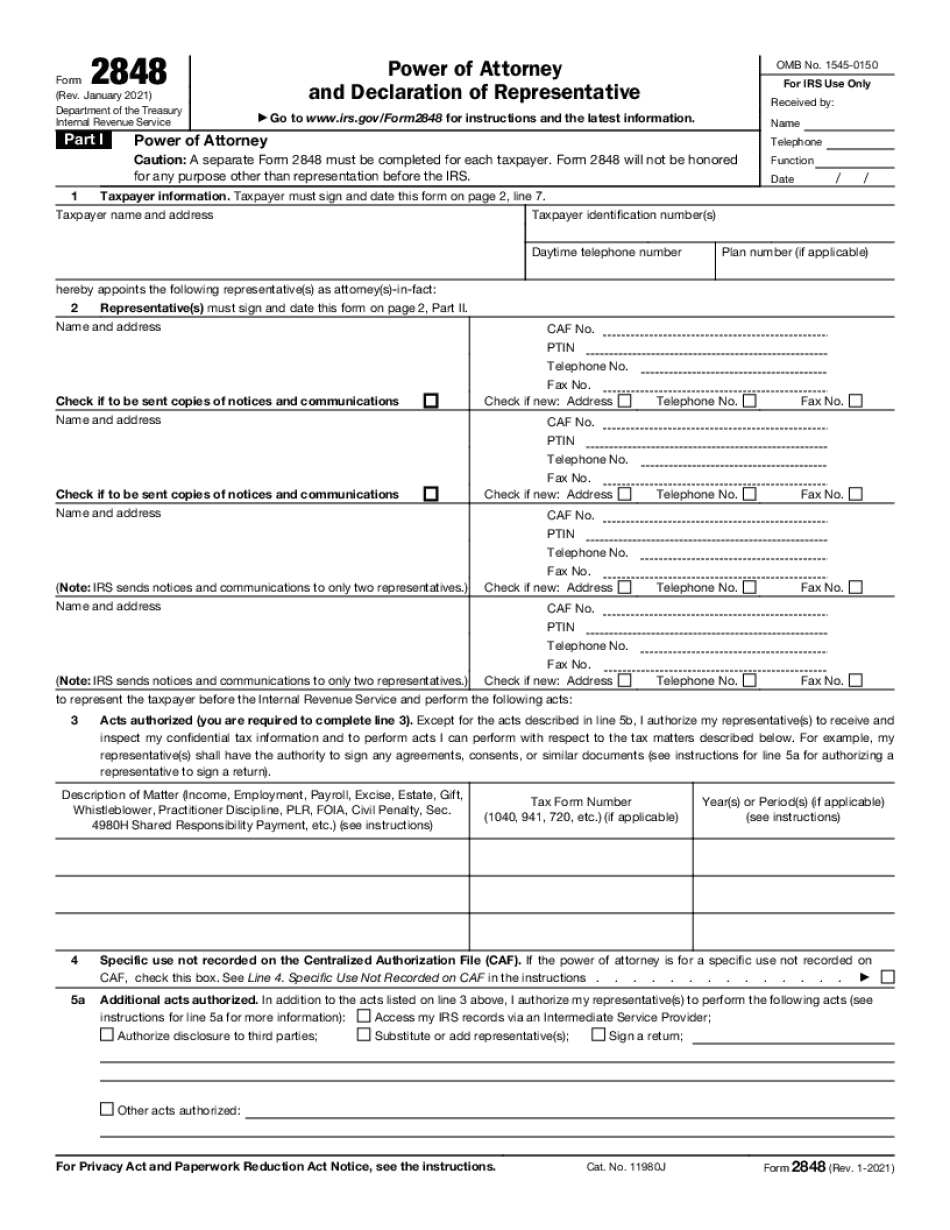

Killeen Texas Form 2848: What You Should Know

Energy Saving Tips A good source for ideas, videos, and articles. Taxpayer Advocate Service filling in the forms for you. Texas Attorney General An online presence with a large database of documents and information on tax law, tax-related business matters, or tax-related legal matters. Taxpayer Education Center An online education resource for individuals and businesses Tax Topic of the Day A comprehensive selection of tax-related topics. Texas Taxpayer Advocate The Texas Taxpayer Advocate Service serves as a resource for individuals and businesses facing tax problems and for state and local government officials who work with taxpayers. The IRS provides several ways for persons requesting assistance to file a tax extension with the Service. The most common methods for filing a tax extension include: a paper application or an electronic application; an automatic stay (the period before the IRS may consider an application for extension of time to file); a Form 1098-T; or a tax e-filed or Form 8888 (for tax years that begin on or after Jan. 1, 2013). There are many other alternative methods for persons filing an extension, including, but not limited to, using other forms of identification, filing Form 4868 with a payee. For information about these alternative methods and for further information on extensions, see IR-2014-9, Extension of Time to File U.S. Income Tax Returns. For information on filing taxes online, go to. Online Tax Assistance Programs at IRS.gov The following website provides some online resources for filing tax returns. Note that the IRS does not offer tax advice or counseling on these sites. The following online resources were developed as part of the IRS's “Get Transcript” program for the 2025 tax year. They provide transcripts of Form 4868(for tax years that begin on or after Jan. 1, 2013). Texas Business Taxpayer Counseling Services at Texas Business Taxpayer Counseling Texas Business Taxpayer Counseling offers taxpayer-friendly tax services to small businesses, individuals with self-employment income, and people who work for companies with taxable income. We are a non-profit tax counsel service dedicated to helping taxpayers prepare their tax returns on time, and paying reasonable fees when necessary. Our service is free and does not require any client contact and is confidential when IRS issues tax extensions.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Killeen Texas Form 2848, keep away from glitches and furnish it inside a timely method:

How to complete a Killeen Texas Form 2848?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Killeen Texas Form 2848 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Killeen Texas Form 2848 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.