Award-winning PDF software

Form 2848 online Stockton California: What You Should Know

This IRS notice is confusing. You'd think it's a joint return with a spouse of the taxpayer. But what does it mean? The IRS says not to do it. Sep 15, 2025 — The IRS has issued the next notice related to joint returns—this one is about the payments of certain credits or tax in prior years—and that notice has a bit of a twist. Read to find out what's up. Nov 5, 2025 — The IRS makes the next set of Notice 2018-C to explain certain credit and tax issues for the year starting January 1, 2023. I see an error in my tax return! Is there anything I should do? — What do I need to know? Jan 22, 2025 — The IRS has issued Notice 2019-A to address the confusion created by Notice 2025 and Notice 2018-C. Find out what that means. Tax professional, do you give a tax lawyer's advice? — Ask the Experts Sep 9, 2025 — The IRS publishes Notice 2018-P, Filed Forms and Certifications Form 8821: Filing of the Certificate of Counsel for a Partnership, which is the Certificate of Partnership Tax (in certain cases). For more information, see Form 8821. Oct 27, 2025 — The IRS issues a list of the types of forms you can file online and for paper-related transactions with the U.S. Social Security Administration. For more information, see I am a U.S. citizen/resident of Puerto Rico, or a U.S. national living in Puerto Rico: what documentation do I need to file U.S. taxes? — What do I need to know? Nov 11, 2025 — The IRS publishes Notice 2018-W, U.S. Social Security Act and Regulations, Part 1 — Publication 105, In Publication 505(A)(4), Part 5, the IRS describes how to file Forms W — 11, 13A, & 13B which report information about Social Security account balances and payments. For more information, see Part 2 — Publication 502, IRS Annual Report of Individual Income for 2025 and the General Instructions for Certain Information Returns, for the year ending September 30 of the year following the calendar year. For more information, see IRS Publication 943, U.S. Treasury Regulations and Guidance regarding Procedures for Designating a Representative for Your Beneficiary on Your U.S.

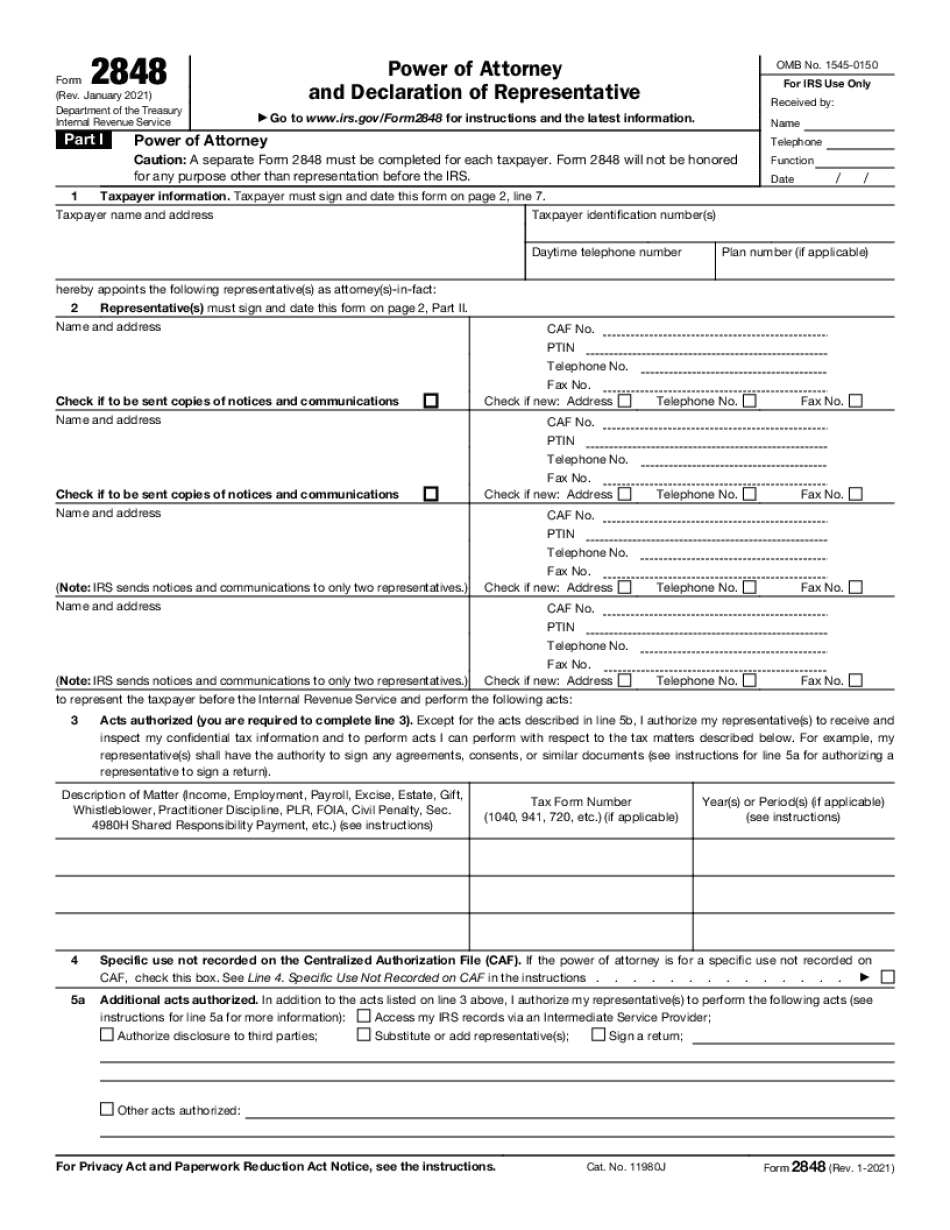

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2848 online Stockton California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2848 online Stockton California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2848 online Stockton California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2848 online Stockton California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.