All right welcome to tax Pro talk or hashtag TDT I'm Tony, and I'm Jim and we want to say welcome to episode 2 this is very exciting we had enough people watched last week, so we came back that'right thanks for watching the pilot begot picked up for many more episodes again tax Pro talk is going to be your weekly update that covers taxes of course your tax products and then we'reveals going to bring some best practice information for your firm so with that let's just jump right in and what's trending this week Jim well our customers are definitely talking about tax reform, and it seems to be the topic of client conversations we're hearing that many of you are being proactive reaching out and communicating with your clients about the tax law about the changes demonstrating your value as trusted advisor and really using this San opportunity to expand tax planning services which is awesome we love there that and last week we talked about in the pilot some new webinars that reopened up we opened up three new webinars in 2018 that actually filled up rather quickly, so customers are predigesting this information very fast butte've opened up I think a few more is that right we have so if you didn't get chance to register when those emails originally went out just return in that same link to the webinar training pageant we've got three new webinars lots more sections added that cover the 2018tax law fundamentals we have a course on tax planning strategies with certified tax coach Jackie Mayer and then we weals have product specific webinars that will cover how to use the tax planner and the new 2018 worksheet in each one of the products that's our pro series...

Award-winning PDF software

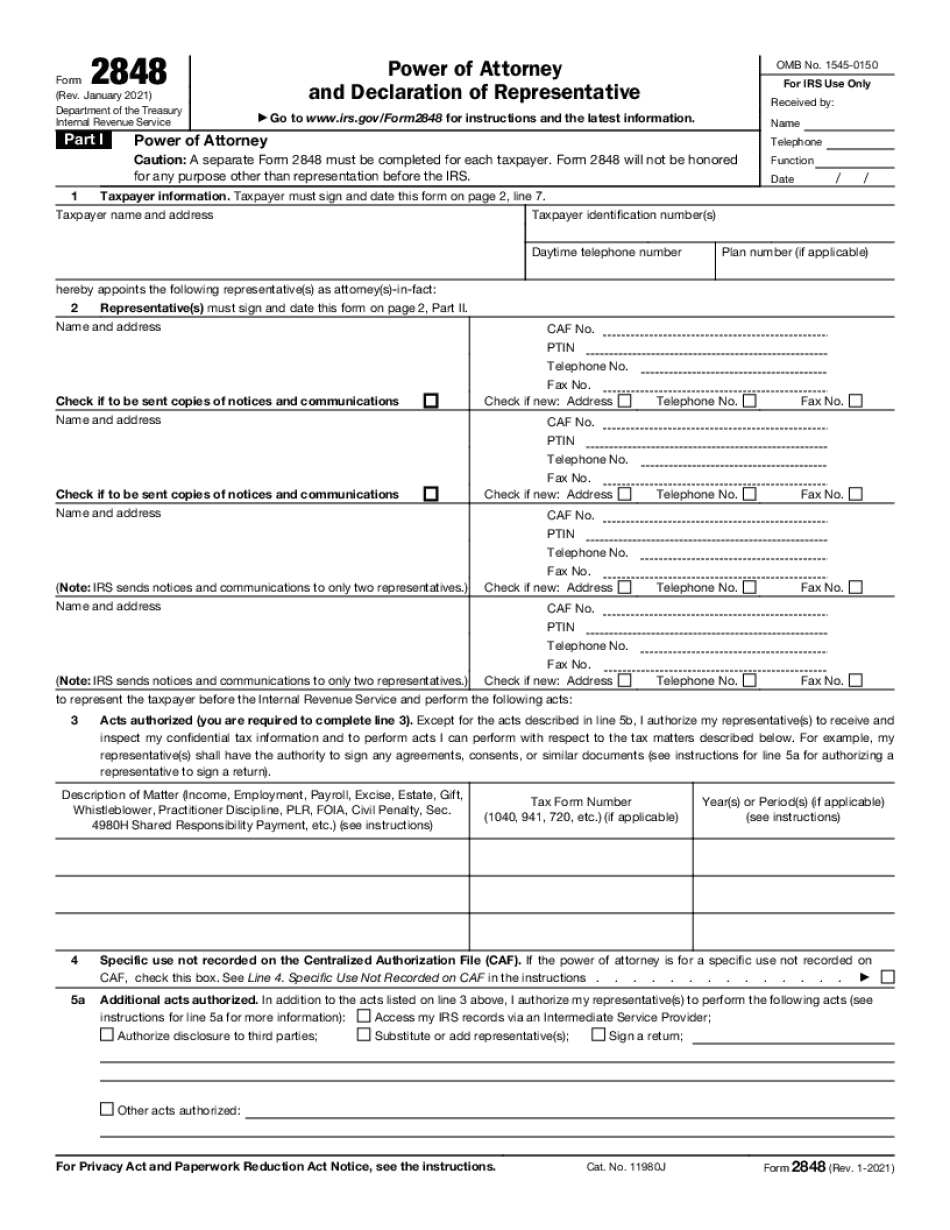

How to prepare Form 2848

About Form 2848

Form 2848 is a tax form that is used by taxpayers to authorize an individual or organization to act as their representative in front of the Internal Revenue Service (IRS). This representation includes activities such as filing tax returns, collecting tax refunds, and making payments on behalf of the taxpayer. The form is generally used by individuals who cannot personally attend to their tax matters, such as those who are elderly, disabled, or living outside the United States. It can also be used by tax professionals, such as lawyers or accountants, who want to represent their clients before the IRS. To use Form 2848, the taxpayer must complete the form and have it signed by both the taxpayer and the authorized representative. The completed form should be mailed to the IRS at the address provided on the form. Overall, Form 2848 is an important tool for taxpayers who need assistance with their tax matters or who prefer to have someone else handle their taxes on their behalf.

What Is Irs Form 2848?

IRS-2848 Form is one of the commonly used tax forms and has to be completed for each taxpayer. It is the Power of Attorney and Declaration of Representative. A form is only intended for representation before the IRS.

The purpose of this form is authorization of an individual to represent taxpayer`s interests before the IRS. Before authorizing a person, make sure he/she is eligible to act on your behalf at the IRS.

Draw attention to the fact that an authorized individual will have the right to receive and examine taxpayer`s confidential tax information.

According to this form an authorized person is empowered to sign contracts, consents and waivers but isn`t entitled to substitute or add another representative as well as to disclose confidential tax information to the third parties.

In order to avoid any misunderstandings or delays, a form should be completed correctly. Prepare a document in compliance with the specified instructions and have it approved.

We offer you to complete an updated fillable Irs 2848 Form sample. A form may be prepared and submitted online as well as downloaded on a computer and further printed.

A blank IRS-2848 must be filled out with the following details:

- taxpayer information (i.e. name, address, TIN, contact details);

- representative`s details (i.e. name and address);

- additional acts authorized / not authorized;

- taxpayer`s signature and date of preparing a form.

A final document has to be forwarded to the IRS. Keep in mind that if a document is not completed, signed or dated, the IRS will return it to a taxpayer. When submitting, remember to enclose a copy of the Power of Attorney. Once a form is completed, check it for mistakes or deficiency of details in order to have a document approved.

Online methods help you to prepare your doc administration and increase the productiveness of your workflow. Stick to the fast information as a way to carry out Form 2848, stay clear of problems and furnish it in the well timed manner:

How to complete a 2848?

- On the web site aided by the kind, click Start off Now and pass towards the editor.

- Use the clues to complete the related fields.

- Include your personal information and facts and phone details.

- Make sure that you just enter appropriate details and numbers in ideal fields.

- Carefully look at the information belonging to the type at the same time as grammar and spelling.

- Refer that can help area if you've got any problems or handle our Help team.

- Put an electronic signature in your Form 2848 aided by the support of Indicator Tool.

- Once the shape is concluded, push Done.

- Distribute the completely ready variety by means of electronic mail or fax, print it out or help you save on your device.

PDF editor allows for you to make variations to the Form 2848 from any net linked product, customize it as outlined by your needs, sign it electronically and distribute in different means.

Things to know about Form 2848

What people say about us

Video instructions and help with filling out and completing Form 2848