Hi, my name is Denise Martin, and I'm an attorney at McChesney & Dale in Bowie, Maryland. I want to talk to you about one estate planning document that we highly recommend everyone consider having: a power of attorney. A power of attorney enables you to appoint an agent who can act on your behalf with respect to business, legal, and financial transactions. Some circumstances in which you may need a power of attorney include being out of town or becoming incapacitated. Often, a power of attorney may be used as an individual gets older and requires assistance from a family member or a friend to pay bills and manage accounts. It's essential to note that a power of attorney can only be used during your lifetime, and its use ceases upon your death. The Maryland legislature has established a statutory-based power of attorney that grants broad powers to your agent. Therefore, it's crucial to select someone you trust as your agent. Your agent will have the authority to pay your bills, handle transactions with your bank, invest your money in stocks, bonds, and other investments, file and pay taxes, manage your retirement benefits, and enter or defend a lawsuit on your behalf. At McChesney & Dale, we use the statutory-based power of attorney and have also added a number of additional provisions that our clients have found to be very helpful in the past. One excellent protection of using the statutory-based power of attorney is that financial institutions are required to accept it. If a bank refuses to accept a power of attorney, your agent has the right to sue and recover attorney's fees. If you have any questions about the use of a power of attorney or other estate planning-related questions, please feel free to contact me.

Award-winning PDF software

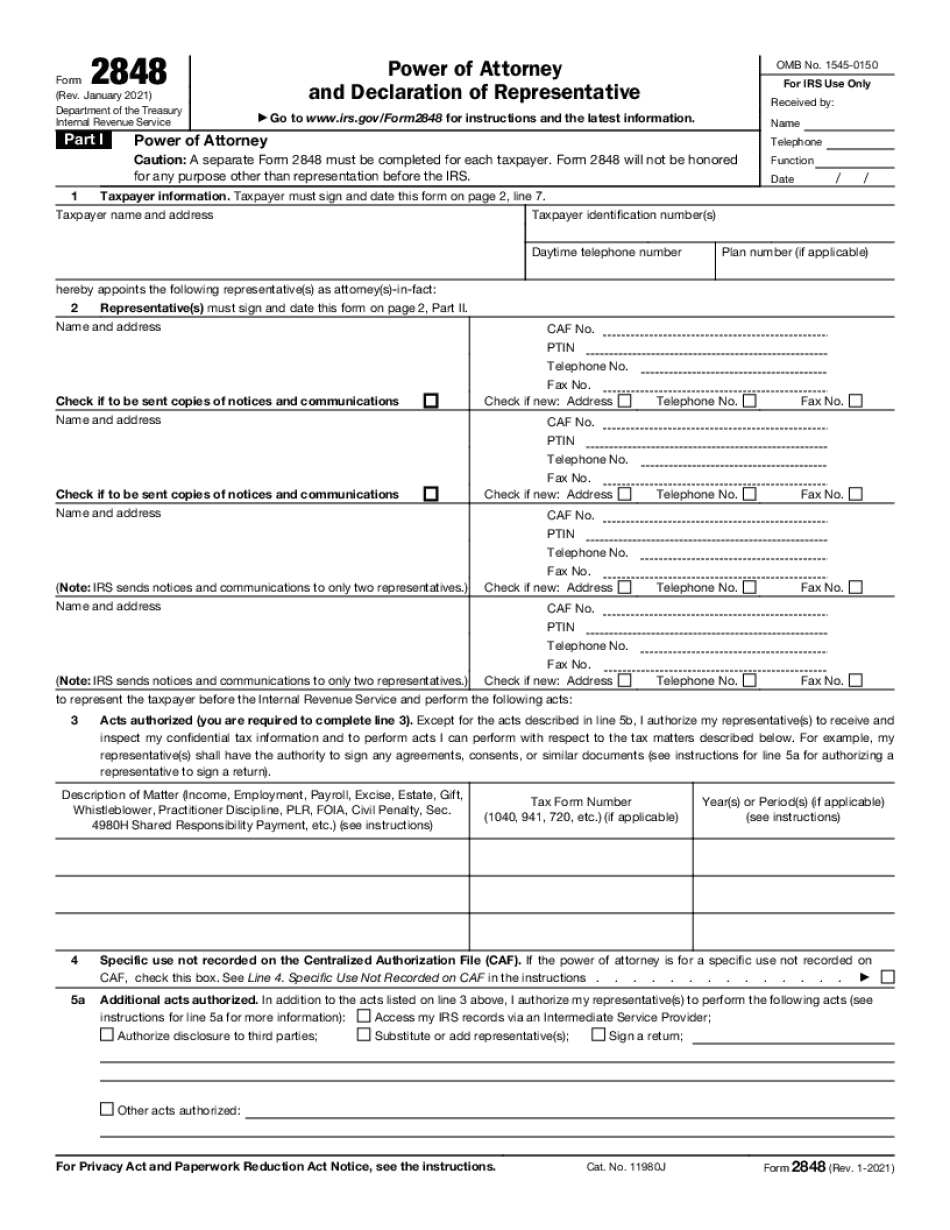

Power of attorney for tax purposes Form: What You Should Know

You should give your POA declaration to the taxpayer and the financial institution the POA describes. The POA declaration should be made in your own writing. Taxpayers may sign the POA declaration and send it to the Financial Institution or the person to whom it is addressed.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2848, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2848 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2848 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2848 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Power of attorney for tax purposes