Award-winning PDF software

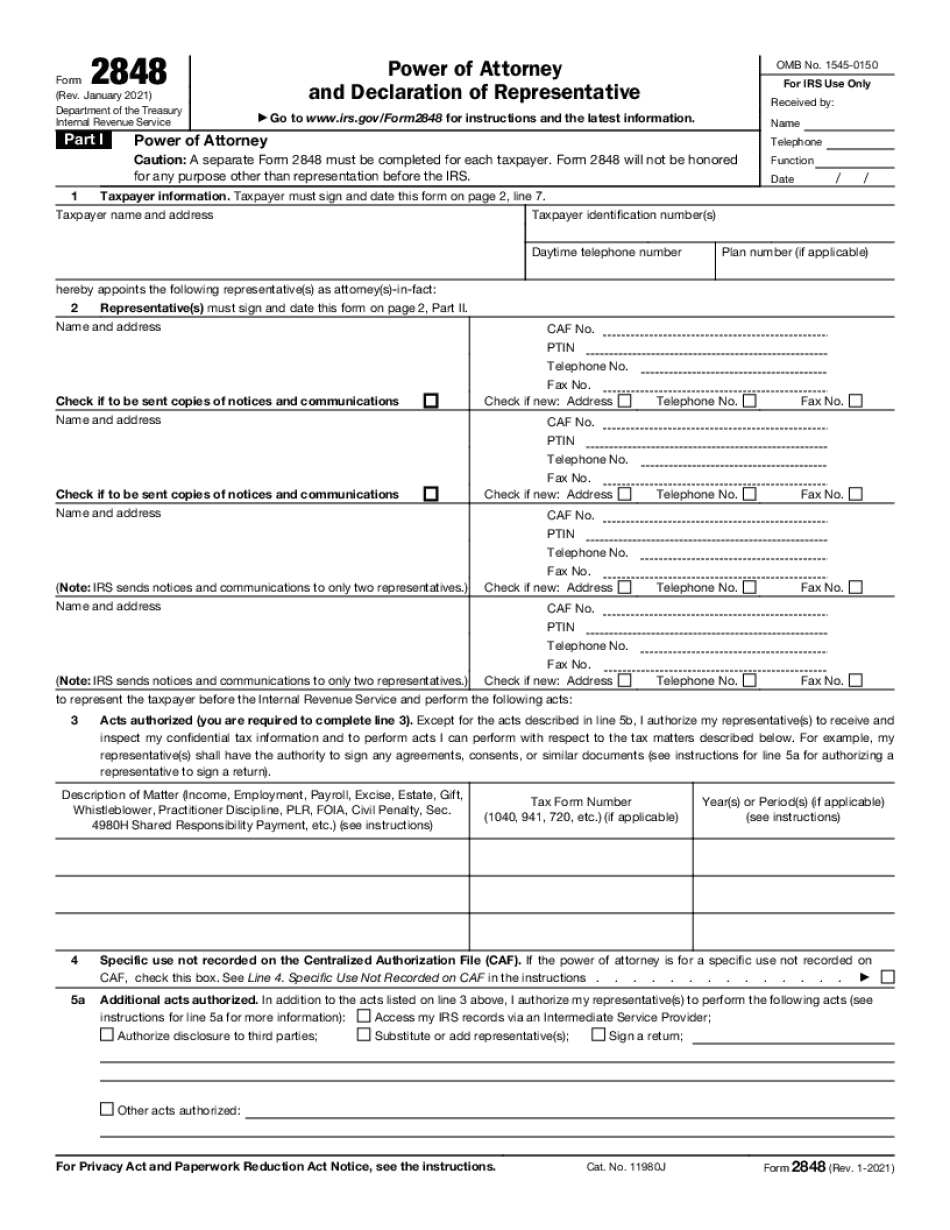

Printable Form 2848 Santa Clarita California: What You Should Know

What is the status of Form 2848? In the meantime, you must keep in mind that an individual may file a Form 2848 to declare that the individual is incapacitated, which includes being confined in a nursing home for an unspecified length of time, being temporarily incapable of performing any of the basic functions of his or her ordinary employment, a physical disability, or illness. In order to prove the incapacity, the individual would need to have a Form 2848 submitted at his or her current tax year tax filing season. If a Form 2848 was filed by an incapacitated individual, the IRS cannot immediately prepare an individual's taxes, but you could continue your own tax preparation on the same form. In an October 2025 statement, IRS Commissioner John Tolkien said the form's purpose is to provide individuals “with the ability to protect their financial interests when it is very difficult to maintain complete and accurate records, due to circumstances beyond their control.” “The only purpose is to protect their tax return from inadvertent omissions or errors in the filing process,” Tolkien said. Form 2848 is a non-refundable tax payment that can be made by electronic funds transfer or credit card, as long as the individual is incapacitated at the time of the payment, according to the statement. If the individual is an adult, the individual is given an account number by the IRS, so they can request a Form 2848 from their account, according to the statement. When the individual is physically unable to provide the information required to claim the tax return as his or her own, an authorization is needed from the individual's financial institution to make the filing. “The individual will need to give his or her financial institution a letter in writing authorizing the financial institution to pay and release the financial institution from liability to the individual on his or her behalf for the tax liability of the individual's personal representatives, including a certified copy of the incapacitation statement,” the statement says. You can read the full statement here: IRS Statement Regarding Certain Changes in Form 2848 (2 pages) In the event an authorized account doesn't exist, the account number will be replaced by the last known account number.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 2848 Santa Clarita California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 2848 Santa Clarita California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 2848 Santa Clarita California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 2848 Santa Clarita California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.