Award-winning PDF software

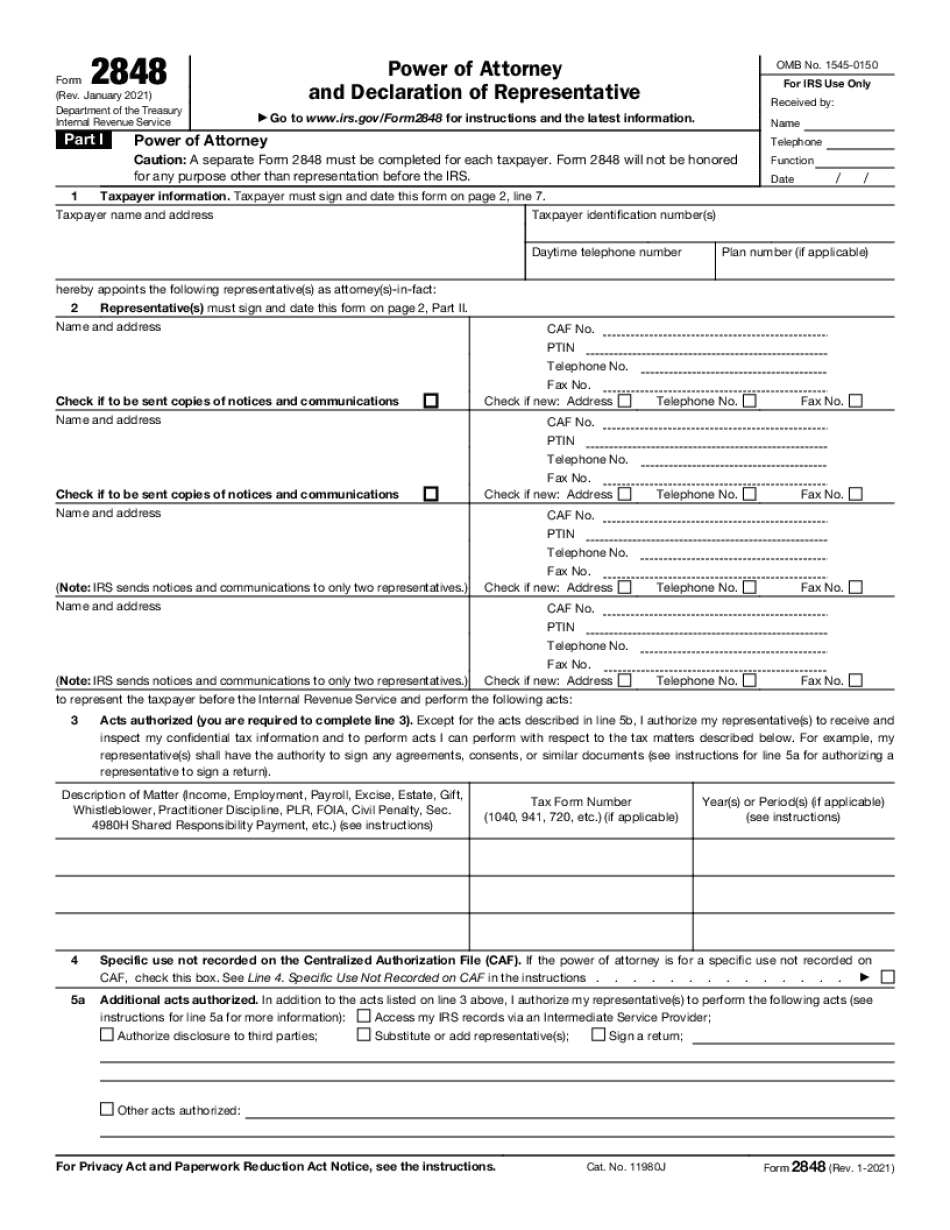

Printable Form 2848 Saint Paul Minnesota: What You Should Know

The power of attorney allows your representative/representative to act on your behalf, such as when the IRS asks to view your tax return or to contact a customer. This document is important to ensure that your representative is properly identifying and complying with the law and your individual tax obligations. The power of attorney is effective only if an IRS representative or a representative of an IRS representative acts on the taxpayer's behalf. If the taxpayer's representative is not an agent of the taxpayer, the power of attorney does not apply to the representative or representative. If there is any doubt with respect to who acts on an individual's behalf, the taxpayer should immediately notify the taxpayer's representative if possible. The provisions for an individual power of attorney apply to the taxpayer and his or her authorized representative. The power of attorney may not be used for any other purpose. The person who signs the form must be at least 18 years old or the legal representative of the taxpayer. If the taxpayer's power of attorney is granted to another individual (for example, the IRS representative) the person who signs the form must attest to its compliance with the law. The power of attorney must be used within one year of the taxpayer signing it and may not be renewed after that time. The power of attorney would remain valid if the taxpayer later changes his or her representatives or does not have a representative. A person or entity that wishes to use the power of attorney must notify the taxpayer before a decision is made to grant it. The power of attorney must be used for tax and nontax purposes and may not be used to obtain personal information, such as credit card information, except for the purpose of obtaining a refund. The power of attorney must not be used to make employment-related decisions. A taxpayer does not have to designate an agent if he or she has a spouse or domestic partner who also signs the form. May 5, 2025 — Update to the Form 2848, for filing under the new Minnesota income tax rules. Sep 14, 2025 — Additional information on the Minnesota income tax rules. Sep 15, 2025 — If the income shown in box 14 of Form 2668 is less than the number shown, the taxpayer may not deduct the full amount shown in box 16. The amount shown “0” might be a “real” exemption or may be “special.” Boxes 20 and 21 of Form 2668 must be reconciled on Form 2868.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 2848 Saint Paul Minnesota, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 2848 Saint Paul Minnesota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 2848 Saint Paul Minnesota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 2848 Saint Paul Minnesota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.