Award-winning PDF software

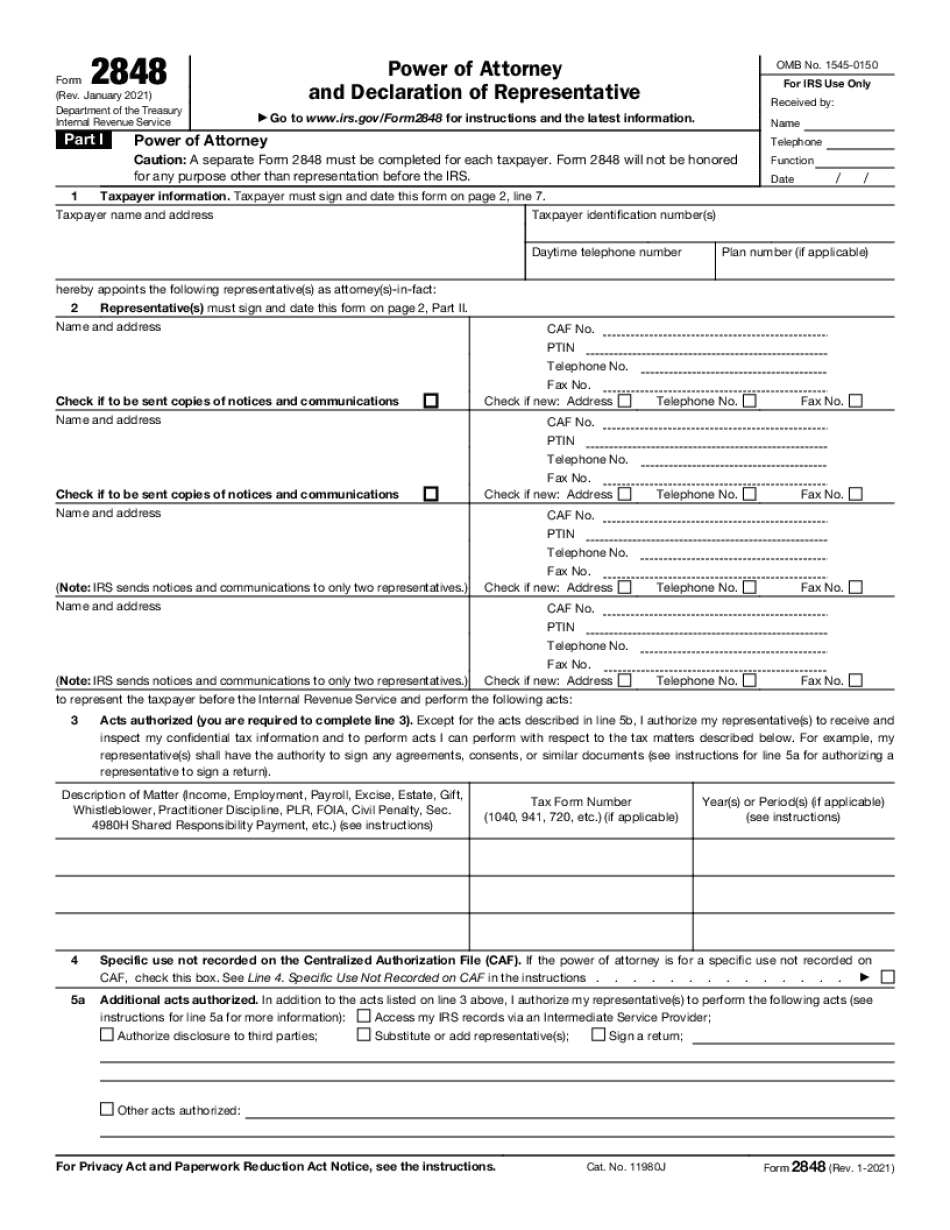

Form 2848 Salt Lake City Utah: What You Should Know

IRS and Utah State Tax Refund Information (Non-Refundable) IRS Free State Tax Refund Assistance Utah tax refunds are not free, and are limited by circumstances related to your eligibility, and the amount of funds that can be withdrawn from your account before the refund is required. For more information, visit IRS.gov. Utah may offer online tax refunds through the state Office of Tax and Revenue Services (OARS) to qualifying individuals for a fee, or to certain non-profit organizations and faith-based entities who maintain their own financial systems. Interest-free tax refunds, on a limited basis, will be made from the date of payment of any taxes for which the refund is being requested. Interest-free tax refunds may be for a set time period only, not for the entire tax year. Interest will be accrued during the three-month waiting period, and will begin accruing when the waiting period ends. Interest will still be charged if the funds are not withdrawn within the three- month period. Interest starts to accrue when the time period ends and may result in an “interest penalty” when funds are not recovered on the due date. A refund check will be issued to the individual whose name appears on the IRS' credit/debit card or checking account. To be eligible to obtain an interest-free tax refund, you must provide the following information on the form: You must be an individual taxpayer (inherited) and you must be a resident of Utah. If you are a resident of another state, a joint return with a spouse or dependent child will NOT be accepted. The information on your IRS tax forms must match the item(s) being requested to claim the refund. You may be asked to complete a separate Form 1099-INT (Individual Income Tax Return) for each item that is claimed for tax refund. The request for and receipt of Utah state tax refunds are limited to tax periods beginning with July 1, 1975, through June 30, 1995. The current return filing deadline for Utah is November 30th, 2013. To receive a Utah online tax refund, you must enroll in the Online Refunds Assistance Program (ORAL). To be eligible for ORAL, you may be required to provide an authorized institution with the following: The name and Social Security Number of the taxpayer you are requesting to receive a Utah state tax refund.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 2848 Salt Lake City Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form 2848 Salt Lake City Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 2848 Salt Lake City Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 2848 Salt Lake City Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.