Award-winning PDF software

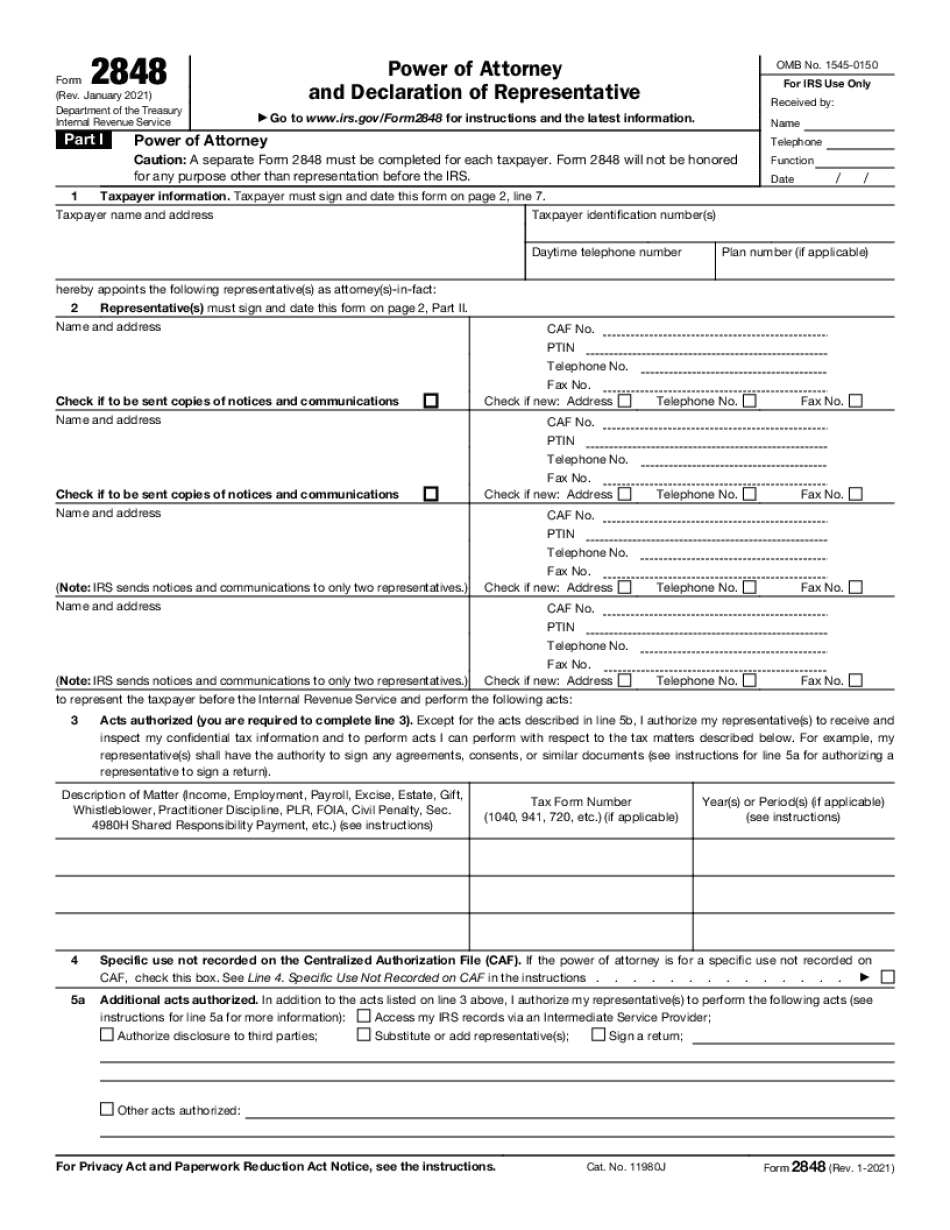

Cincinnati Ohio Form 2848: What You Should Know

Taxpayer Enrollment in the Ohio Taxpayer Assistance Center (OTC) Program — OTC This website contains useful information about the different options with which to enroll yourself in the Ohio Taxpayer Assistance Center (OTC), and offers free tools to assist you with your application. Also, click the “For Service Members” button at the top of the page for a helpful tool available to the public. About the Ohio Taxpayer Assistance Center (OTC) — The Taxpayer Assistance Center in the Ohio Taxpayer Assistance (OTC) Program serves qualified taxpayers by providing information, education, and assistance in the following areas: Credentialing for Individuals. Tax credits and deductions. State and local income taxes. Public benefits and exemptions. Tax preparation and state and local tax forms. Income Tax: Ohio's Individual Income Tax The tax code is based on the principle that everyone is taxed on all income they earn, regardless of how they earned it. Therefore, everyone has to file tax returns on their own. Who Does not Need to File an Individual Tax Return? The following individuals and certain estates do not have to file income tax returns: If you or someone in your household is an independent contractor, you cannot be taxed as if you are an employee. Your spouse is generally considered a dependent for tax purposes and is also exempt from paying taxes on his or her own income. Your dependents include your spouse and dependents who are under age 21 as well as the following relatives: a spouse for all unmarried children of divorced or separated individuals, a parent, sister, brother, uncle, aunt, nephew or niece of you who is not your spouse, your parents or any spouse or dependent for whom you are filing a statement. Your dependents are your: Child(men) under age 17(if married) Is an estate of an individual has survived the individual's death, there is no separate federal estate tax. Under Ohio law, the estate tax only applies to estates of nonresident aliens, estates of federal military personnel, estates of certain disabled veterans, and the estates of estates in interstate commerce. The IRS defines qualified business franchisees to be any individual who controls at least a 10% interest in an Ohio corporation which engages in or produces taxable goods and services. Your wages may be taxable to the extent they include business income if you are a nonresident alien (or an estate of nonresident aliens).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cincinnati Ohio Form 2848, keep away from glitches and furnish it inside a timely method:

How to complete a Cincinnati Ohio Form 2848?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cincinnati Ohio Form 2848 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cincinnati Ohio Form 2848 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.