Hey everybody, this is Dave coming at you from the verified news channel of Freedom Watch dot us. I got my letter back from the IRS today. As you may recall from previous videos, the IRS is saying I owe money because I didn't understand the filing requirements back in the mid-90s. They placed a nasty lien on me, enough to buy a new car. At that time, I didn't know anything about sovereignty or read any law. I basically went into financial hiding for a while. However, I'm not in financial hiding anymore. There's still this lien, and I've called them a few times. Finally, after many attempts, I managed to get my hands on the documents that prove I don't owe them any money, like the 1099 from Charles Schwab. So, I sent those documents along with a letter. The letter basically says, "Hey, I'm sorry I didn't file. I didn't understand the handbook. I thought it meant net income, not gross income when it said I didn't have to file. Here are these documents that prove I don't owe you any money. Please remove the lien." It was just a nice letter, like anybody would write, admitting a mistake. So now, I'm looking at their response and listening to what he says, and it's interesting. There's a wedding signature on it, from Jay Abid Santos, God's employee number here. He says, "A quick review of your records shows the following: You still owe for the 1997 tax year, and the lien is still active." I already told him that in my letter, the moron. Except for the part where I owe, the 1997 tax return was filed by the IRS under provision of 6020(b)(3)(01). That's the IRS code. 6020(b)(3)(01) means substitute for a return. Okay, so the...

Award-winning PDF software

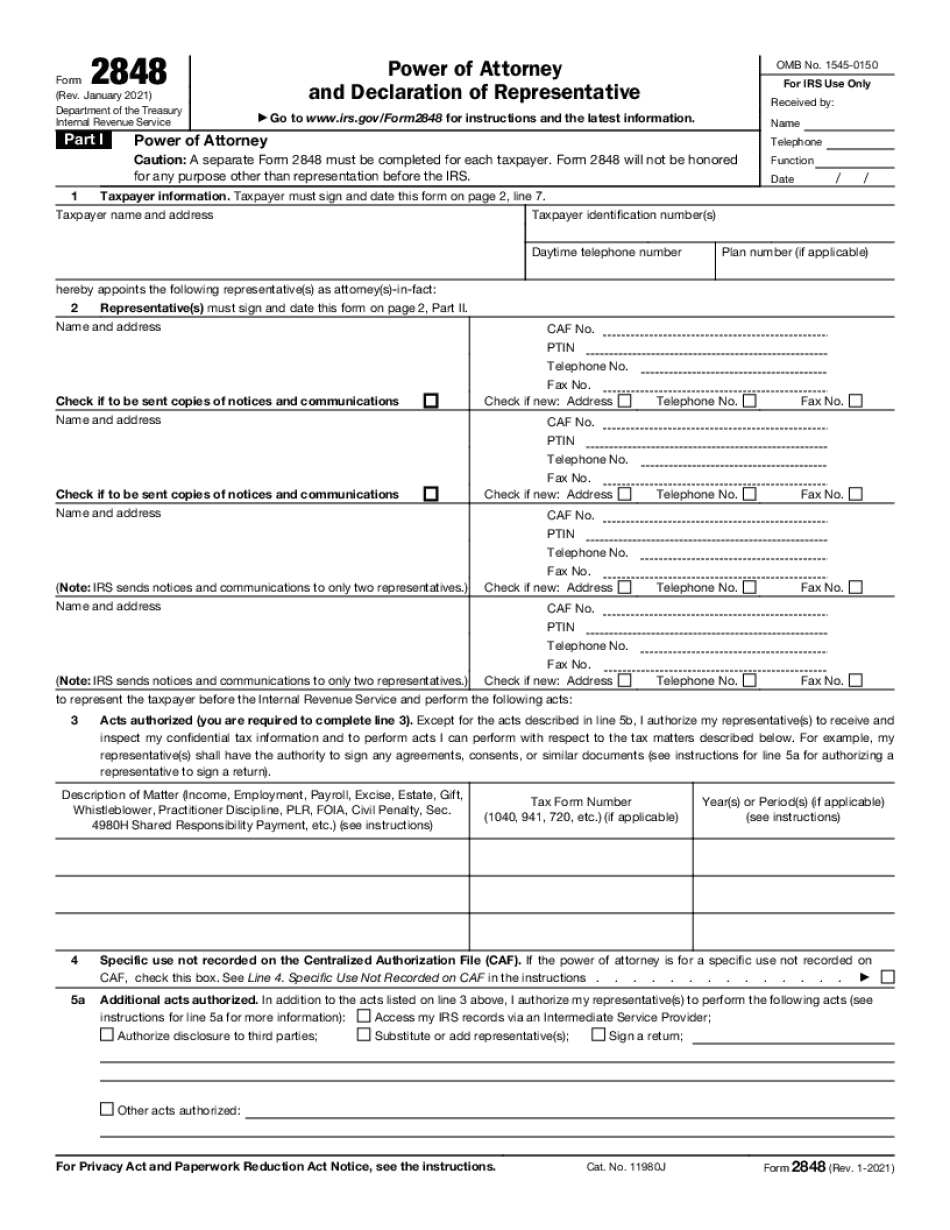

How to complete 2848 Form: What You Should Know

Fillers: Fillers: Fillers: Signatories: What if, after filling out Form 2848, someone asks if they can get the taxpayer information in person? You can, if: You are authorized to act for the taxpayer or are providing related services, as explained in Line 5. As explained in Line 8. Your act or role is authorized in line 10. You are acting in the normal course of your business. For more information, see chapter 10. Do you have copies of the required forms and instructions? Yes. You don't have to answer this question unless you are asked a question that is unrelated to the question of filing Form 2848 electronically. What if you do not know whether you are authorized to make and sign Form 2848 and need advice on whether you should complete it? The answer to “What if I am not authorized to fill out Form 2848 and need advice on whether.” answers this question. If you are unable to complete Form 2848 because you don't know whether you are authorized to fill it out then you must complete it. What happens if I fill out Form 2848 but the person to whom I'm authorized to act doesn't sign it? You will need to make a second copy of Form 2848: You will need to make a second copy of Form 2848 before you file it electronically. If you need to make a second copy of Form 2848 before filing it electronically then you should include a Form 8858 Statement of Identification and Certification with your electronic return. What can you do if you fill out Form 2848 but don't receive authorization to file electronically before filing the return? — For information about what can happen if you don't file the return electronically and your return is rejected for refund, see the following guidance in the Taxpayer Advisory Notice (TAIL) 5516, How to Fill Out Form 2848 and Sign Your Return, and IRS Revenue Ruling 5810. What happens if you send Form 2848 to someone else? — You can send your Form 2848 to a spouse or common-law partner, a child under your care or an eligible relative — see the TAIL 5511 instructions.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 2848, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 2848 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 2848 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 2848 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to complete Form 2848